UN- Democracy of Crypto

While the Dow sinks and inflation soars, and the likes of Three Arrows and Celsius go the way of other first liners in economies of Christmas past, crypto is emerging as the great elevator of the little man. Oh sure, the bears are roaring with each passing day. Still, if necessity is the mother of invention, those bears are simply a catalyst for the tech-minded huddled masses of the world’s historically forgotten impoverished.

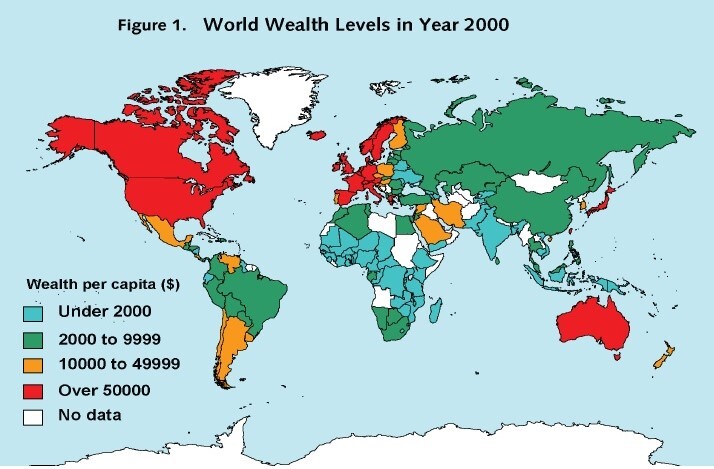

Each morning that the Cryptoverse teeters on the brink and each evening when it roars back to life, a tide of men and women who have been locked out of traditional finance via Bank of America and Wall Street, find wealth and advancement despite their inauspicious beginnings in places like Bhopal, India and Lagos, Nigeria.

According to c-sharpcorner.com, of the top ten countries with the most crypto holders in the world, India comes in the top spot with over 100 Million or 7.5% of the nation holding crypto. Nigeria comes in at the number four spot with just over 13 Million holders of crypto, or nearly 6.5%. Who you ask is Number 2 and 3?

The U.S. lands in the number two spot with almost 27 and a half million holders, and Russia is number three with 17 and half million holders. The Russian crypto world was rocked on Friday when Vladimir Putin made using crypto as currency in the land of Tsars a crime, but if trends hold true there, the holder’s number won’t drop as most crypto is used for trading rather than currency.

This trend to use crypto as fodder for trading makes it such a democratic wealth builder. As long an investor has a somewhat stable Wi-Fi connection, fortunes can be made trading one of the thousands of coins available on crypto trading platforms, many for just a few cents.

When your entire financial portfolio is only worth $3, you can buy quite a few coins if they are only five cents. It’s what happens when you buy coins like Ravencoin valued at less than 2 cents at the time of writing that is seeing a 30% jump in value, that turns a $3 investment into $4 or $5 in the space of a day. When your family lives on less than $1 a day, the returns on a $3 investment can go quite a long way.

When you add in the use of a bot or algorithm to that kind of investment, which can move faster than the speed of light in trading and detect the smallest micro shifts in the markets, you can see exponential gains from the little coins in a bear market.

Financial masterminds like Robert Grezsik of Lumiwealth are training newbie investors from around the world to build these bots and say, “The beauty of crypto is that most exchanges fees are relative to the size of your trade, and you can trade very small fractions of things. $10 is more than enough to get started… We’ve built a whole company around this. ( Investment algorithms) How do we use software to make people money, how do we improve people’s investment returns.”

Between the emergence of cell service worldwide, the availability of micro-investing in small value coins in crypto, and technological advancements like the bots created at Lumiwealth, the scene is set for an increase in world wealth in a way never before seen in history.

In April, WeForum.org reported that the world income gap had worsened as a result of the pandemic, while fisglobal.com reported one month earlier that crypto use had skyrocketed. These two statics are no coincidence. It is a trend that is changing the distribution of world income in a more democratic way than any world policymaker or financial sector manager ever could.

However, as c-sharpcorner.com also reported in the same report which put India, the U.S., and Russia at the top of the list of crypto holders, 82% of the crypto holders worldwide held a bachelor’s degree or higher. This means now more than ever, education will play a role in elevating the poor from poverty.

Thumbnail Credits: United Nations

Sources

- Top 10 Countries With The Most Cryptocurrency Holders

- The Crypto Nightly News for July 18, 2022: Web 3.0 or Bust

- Wealth gap widens as pandemic deepens economic inequality

- Cryptocurrency usage skyrockets – Insights | FIS